Dollar-Cost Averaging and Reverse Dollar-Cost Averaging

Submitted by Robert Gordon & Associates, Inc on January 10th, 2018

Dollar-Cost Averaging

So, what is dollar-cost averaging?

Dollar-Cost Averaging: The technique of buying a fixed dollar amount of a particular investment on a regular schedule, regardless of the share price.

-Investopedia

The problem with investing a lump sum of money is that if the price per share drop dramatically, the entire lump sum will be greatly reduced in value. Dollar-cost averaging helps protect against this possibility by dividing up a lump sum and investing the portions over time.

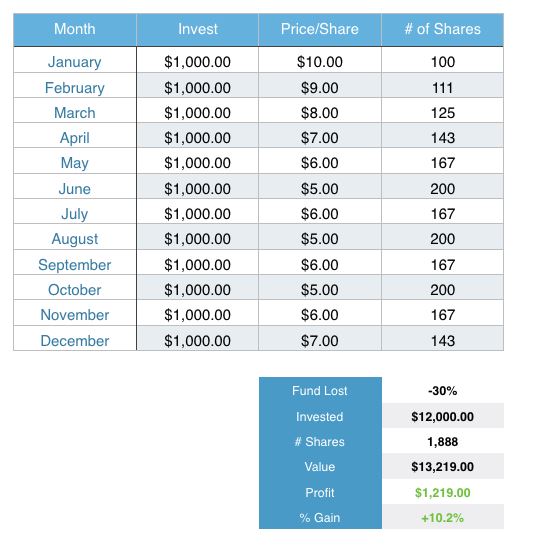

Let’s take a look at an example of dollar-cost averaging at work:

As you can see, there was a nice gain thanks in part to dollar-cost averaging. Investing on a regular schedule lowers your risk due to the power of dollar-cost averaging.

Reverse Dollar-Cost Averaging

Now, let’s say you’re retired and instead of investing money on a regular basis, you’re withdrawing money on a regular basis. If investments are being sold on a regular basis to fund your retirement lifestyle, reverse dollar-cost averaging takes place and forces you to sell your investments regardless of the price per share. If share values are low, you will have to sell more shares to get your predetermined withdrawal amount than when share values are high.

As you’re aware, it’s important to buy when share values are low and sell when share values are high. Selling regardless of market conditions is not wise. It’s important to be strategic with your withdrawals and take advantage of certain market conditions. While timing the market isn’t generally recommended when you’re putting money into investments, timing the market when you’re withdrawing from investments isn’t only helpful, it’s many times necessary.

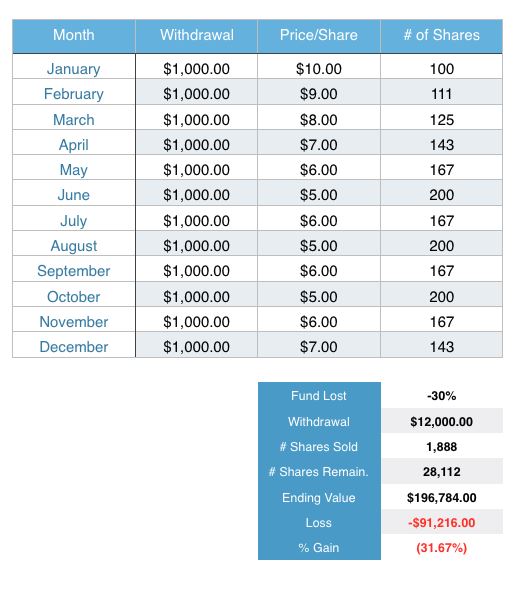

Let’s take a look at how reverse dollar-cost averaging can negatively affect an investor who is in retirement and taking withdrawals. Let’s suppose the investor starts with $300,000 or 30,000 shares. The investor plans to take $1,000 from their retirement account every month. Let’s see how this breaks down over the course of a year in the table below:

As you can see, while the investor’s withdrawal rate remains the same, the price per share fluctuates and therefore requires a variable number of shares to be sold every month. Sometimes the price per share is high, other times, the price per share is low.

How did reverse dollar-cost averaging affect the investor? Negatively. Here’s the break down . . . .

The fund, unsurprisingly, lost 30% of its value with a total withdrawal of $12,000. There were 1,888 shares sold and 28,112 shares remaining. The ending value of the account was $196,784. This means there was a $91,216 loss which translates to a 31.67% loss.

As you can see from the example, withdrawing money on a regular basis during volatile and negative markets not only reduces the account value, it also reduces it even further due to the negative affects of reverse dollar-cost averaging.