Budget

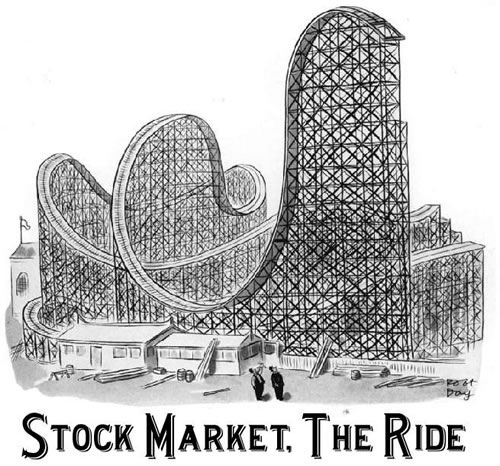

Managing Emotions and Expectations during Market Uncertainty

Submitted by Robert Gordon & Associates, Inc on March 27th, 2020

Riding the highs, and experiencing the lows, it is the way of the investment market. However, what if we told you that the key to sound and quality investing is learning how to keep cool when the market is in turmoil? In this article, we look at some of the techniques that can help you manage your emotions and expectations during market uncertainty.

Covid-19 Helpful Resources

Submitted by Robert Gordon & Associates, Inc on March 27th, 2020RGA Letter to Clients and All Investors

Submitted by Robert Gordon & Associates, Inc on March 16th, 2020

We sent this letter out to our clients last Thursday, March 12th. As the situation progresses, the temporary losses in the market continue and there are more people getting infected by the virus every day. In the latest attempt to curtail the spread, the President is advising against groups of 10 or more people.

What's an Alpha Manager and Why Do I Need One?

Submitted by Robert Gordon & Associates, Inc on February 12th, 2020Think Your DIY Retirement Plan Can Beat an Advisor?

Submitted by Robert Gordon & Associates, Inc on February 8th, 2020Do You Have Great Expectations for Your Investments?

Submitted by Robert Gordon & Associates, Inc on January 23rd, 202020 Financial Resolutions for 2020

Submitted by Robert Gordon & Associates, Inc on January 10th, 2020Don't abbreviate 2020. It's for your own good!

Submitted by Robert Gordon & Associates, Inc on January 6th, 2020How to Teach Young Children to Save and Invest

Submitted by Robert Gordon & Associates, Inc on January 2nd, 2020

It can be both fun and educational for your kids.

When it comes to teaching children about money, you should get them involved early…as young as 7 or 8 years of age. Have them help with the bill paying. Expose them to preparing your tax return. And, if you have the money, set up a brokerage account for them. Let them pick a stock or two.