Budget

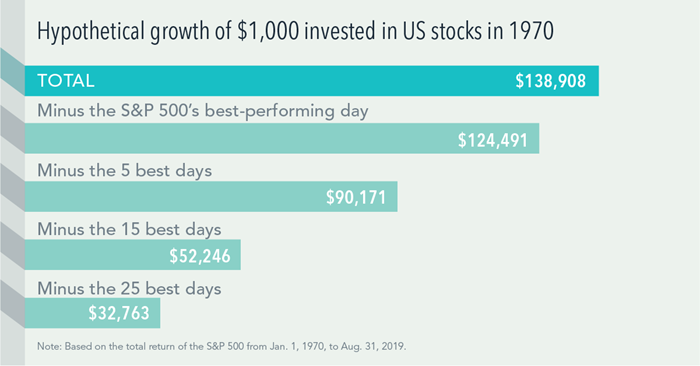

What Happens When You Fail at Market Timing

Submitted by Robert Gordon & Associates, Inc on November 26th, 2019The Worst Decision You Could Make Is No Decision At All

Submitted by Robert Gordon & Associates, Inc on May 6th, 2019

It’s official: Money is stressful. Surveys consistently show that money is the top source of stress for American adults. More than a quarter of Americans say they feel stressed about money most or all of the time. Only 30 percent rate their financial security as high, and more than two-thirds believe that more money would make them happier.

Video: Financial Literacy for Children

Submitted by Robert Gordon & Associates, Inc on January 4th, 2019

What is a Health Savings Account?

Submitted by Robert Gordon & Associates, Inc on October 11th, 2018

Let’s face it, medical expenses can have a major impact on your budget, especially as you get older.

If you’ve heard about a Health Savings Account or maybe your work offers one, then it just may make sense to give it some serious consideration – and, in my opinion, it typically makes a lot of sense.

It's World Financial Planning Day!

Submitted by Robert Gordon & Associates, Inc on October 4th, 20184 Ways to Deal With Debt in Retirement

Submitted by Robert Gordon & Associates, Inc on August 29th, 201813 Habits of Financially Savvy People

Submitted by Robert Gordon & Associates, Inc on June 18th, 2018

Being financially savvy will mean different things to different people. But a common trait that the money-smart share is an affinity for long term financial planning and goals.

Those who are great at it don’t have to make huge sacrifices, but still manage to enjoy a high standard of living while traveling and pursuing a range of hobbies.

Graduation Season Is here - How to Start Down the Path Towards Financial Success

Submitted by Robert Gordon & Associates, Inc on April 27th, 2018

With another graduation season upon us, young people are trying to make the transition from college to colleague. There will be big changes and challenges ahead. If you can start off on the right financial footing in your 20's, you will be leaps and bound ahead of others that don't get their finances in order until later in life.